Chinese Cryptocurrency Ban and Fleeing Miners

- Published On: 3 Jul 2021

- Categories: News

Cryptocurrency has been the buzzword of the year among everyone as people have started investing in it through various means. Cryptocurrency acts as a medium for online transactions and fund transfer as it is a digital currency with rates that differ from time to time and can be mined and stored as per the user’s needs. The most used cryptocurrency is Bitcoin, with the total value of the market cap at over $641 billion as of June 2021.

China dominated Two-thirds of the entire cryptocurrency market until recent events, which can only be termed the Chinese crypto ban.

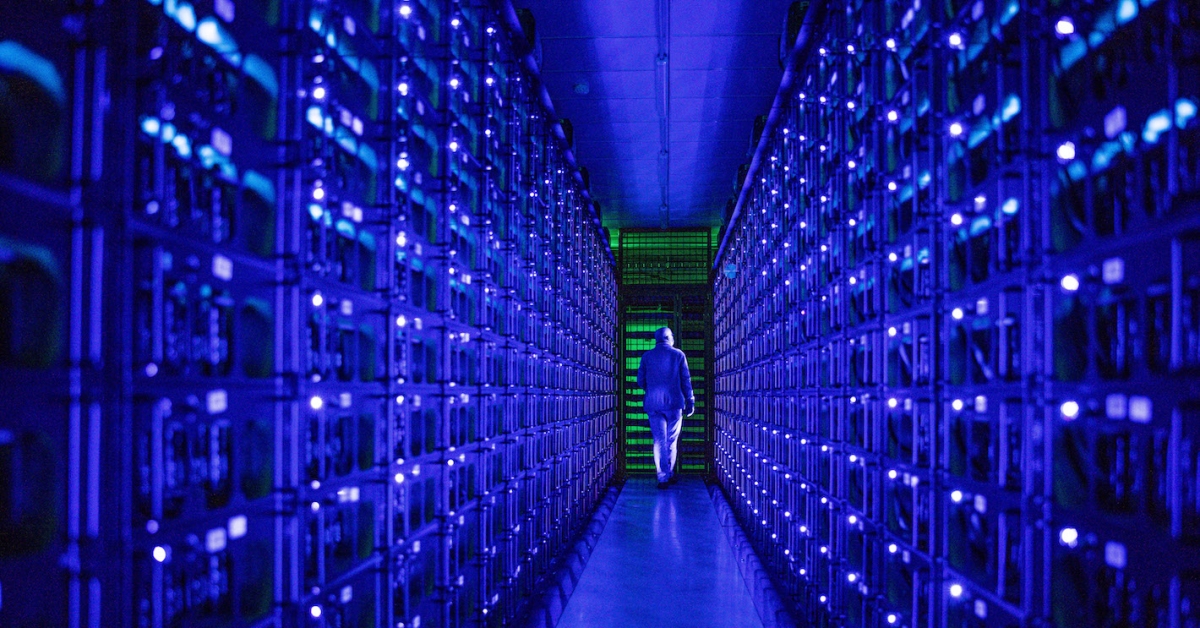

Bitcoin is obtained through data mining which involves a lot of computational work; therefore, powerful and intricate setups are required to start mining. These setups are also termed mining rigs, and since these rigs are computing terabytes of data daily, they need a lot of power to operate. The setting up of rigs is an expensive process already, and the power requirements double that initial figure. China’s old policies allowed for cheap power obtainment for the major crypto miners situated in major cities. The Chinese crypto ban policies will result in almost 90% of all Bitcoin mining in China going offline.

History of Bitcoin and cryptocurrency in China

The government of China and many other governments duly expressed their concerns regarding the trade and handling of Bitcoin. The nature of Cryptocurrency like Bitcoin is volatile, as its value is never fixed and keeps going up and down at a moment’s notice. The Chinese government believes that the economy is adversely affected, and cryptocurrency is nothing but a forefront for money laundering.

China has been very strict about its policies regarding the handling of Bitcoin and its trade in the country, but the Chinese crypto ban takes the top spot as the ultimate sweep attempt to stop the flow of Bitcoin in China permanently.

The tight watch on Bitcoin in China started around 2013 when the Chinese government banned local and commercial banks from handling Bitcoin after a drastic change in the value of Bitcoin over the course of three days. They then proceeded to put an end to fundraising and kick starter programs with the help of Bitcoin deposits in the year 2017. The penultimate hit occurred in June of 2021 when the government passed policies that banned the mining and local trade of Bitcoin on all levels.

As per a report in the Economic Times, dated June 25, 2021 – “China’s central bank, The People’s Bank of China (PBOC) met with several domestic banks and payment firms such as Alipay, urging them to tighten restrictions on cryptocurrency trading and directing them to stop facilitating cryptocurrency transactions. These institutions must also comprehensively investigate and identify crypto exchanges and over-the-counter capital accounts of dealers and cut off the payment link for transaction funds in a timely manner.”

Consequences of the Chinese Crypto Ban

The Chinese crypto ban was carried out in a way that mining cryptocurrency was seen as a problem, and the source of the problem was taken out to solve it. In this case, it was power and electricity; the government of China has ordered the electrical board to cut off all sources of power to the companies involved in Bitcoin mining. As mining is a very power-consuming process, this move rendered the rigs useless. Major areas of China like Sichuan and Xinjiang, which housed the largest mining companies in China, faced these issues and were forced to shut down their operations. ShentuQingchun, CEO of Shenzhen-based Blockchain Company BankLedger stated, “We had hoped that Sichuan would be an exception during the clampdown as there is an electricity glut there in the rainy season. But Chinese regulators are now taking a uniform approach, which would overhaul and rein in the booming Bitcoin mining industry in China.”

The Chinese crypto ban also affected the entire lot of people working at these companies or the owners of the business. As per media reports, Bitcoin mining pools backed by Chinese companies such as Binance, AntPool, and Huobi Pool have experienced a drastic plunge (20%-40%) in the real-time hash rates within the past 24 hours. In one day, these companies faced losses in the billions, and their livelihood was taken away from them. The expensive and intricate rigs for mining have been rendered useless, and the owners are now selling away these rigs as pieces of scrap metal at bare minimum rates and moving onto other jobs as all they had were the mines to keep them going.

The migration of miners

The people involved with the companies that mined and traded Bitcoin were left with nothing after the Chinese crypto ban. The only way to save their livelihood was to move to other countries to continue with Bitcoin mining without much interference. Hence, they started to migrate towards countries like the USA and Canada. As per a report by The Global Times, dated June 20, 2021 – a Sichuan-based industry insider stated, “The exit window is closing, and we’re scrambling to find overseas mines to place our mining devices.”

These countries offered them a single factor- freedom to continue doing what they do without interference as these countries allow the trade and mining of cryptocurrency. Most of the people who were established to an extent in China just started over in new countries since they had the resources. However, the start-ups affected by the Chinese crypto ban had to bring their assets overseas, which meant that they had to sign over their rigs as property of the country they moved to. Until they have reached a point of self-sustainability, they have no choice but to work on a collaborative basis.

China’s largest maker of cryptocurrency mining machines – Bitmain has suspended its product sales and is exploring alternatives overseas where the power supply will not be a major issue. They include places like Canada, the United States, Russia, Australia, Indonesia, and Kazakhstan.

Hence, people are left with no other choice but to resort to fleeing to other countries where crypto mining is legal. As the government of China pushes the regulations further, this movement of people will be an upward trend.

Crypto media

The Chine crypto ban also presented itself to the citizens of China differently by blocking and suspending accounts of companies that dealt in Bitcoin mining on their version of Twitter ‘Weibo’. The accounts were blocked for the promotion of illegal money laundering and going against the laws of the nation. The Chinese government also states that ‘there will be no Chinese Elon Musk in the Chinese crypto-market.’ This was a nod to the fact that these companies influence people and as social media plays a big part in mass influence, blocking them was a crucial step in the Chinese crypto ban.

Elon Musk, the owner of Tesla, is among the most powerful people on the planet. A single tweet from him back in May 2021, which announced that Tesla would no longer accept Bitcoin, almost led the entire Bitcoin market to crash. The value of Bitcoin dropped due to that one tweet and hit its all-time low. The Chinese government was already not in favor of the volatile nature of Cryptocurrency; therefore, they could not let these companies that counter influence the Chinese crypto ban flourish.

The future of the Bitcoin market with the Chinese gone

As China held nearly 71% of the global flow of Bitcoin, the market is going to face massive losses, and the entire market may be overthrown by either a different type of Cryptocurrency or a lot of companies are going to move their operations to overseas locations as a means of survival. This will lead to a global impact as Bitcoin was already on an all-time low value, the Chinese crypto ban will add to the losses.

The Chinese crypto ban sure achieved what it set course for, putting an end to the Cryptocurrency trade and mining in the country. Some percentage of the Bitcoin business may still go on functioning through over-the-counter transactions, but with passing day, the companies have resorted to hoping for a miracle that may save their companies.

Upcoming global issues

China was the forerunner in the Bitcoin market, and many other countries involved in mining looked up to China. This implies that another country may replace the position that China held up until now, and rebalance the market scenario or the entire market may shift to other forms of cryptocurrency with Bitcoin being de-valued forever. The nature of Bitcoin was uncertain, and the Chinese crypto ban has successfully added to the uncertainty for both the Cryptocurrency market and the country.

First time preordering a miner and was very happy with the results and getting it before prices went up and…

As a beginner miner, it was not easy to find a reputable company to start to deal with. I decided…

Product work well for now. They look new as advertise. Processing have been fast and easy.

Received sample unit at their Dubai store. Super happy with the transaction.

Never mind. I just realized it doesn't save the shipping fee so I will just make another order. Please close…